QUANTAMENTAL EQUITY SELECTION

QUANTITATIVE MODEL

The proprietary model is based on extensive literature and has been widely back-tested. The methodology has been first implemented in 2012 and has been continuously updated since then.

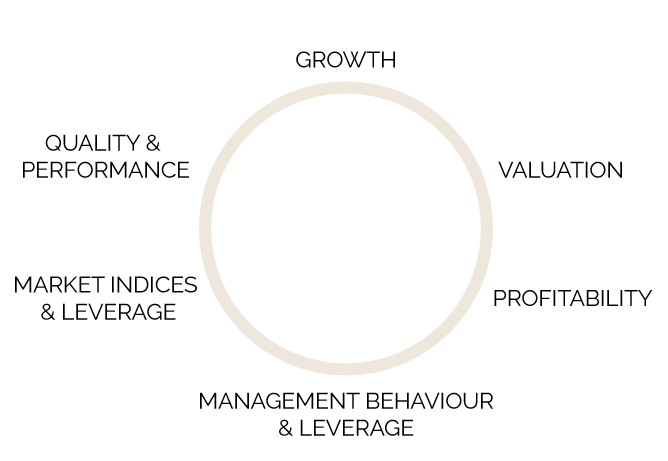

- It is a multi-factor model that can be applied to any universe, apart from financial companies.

- The model ranks the constituents of the universe based on several factors, including but not limited to growth, quality, valuation, and price performance.

-

Growth is a scarce resource. The presence of Growth limits the risk of value traps.

-

Quality is measured in different ways: Optimization of all factors of production like Capital, Employees, R&D etc., and Balance Sheet and P&L Measures.

-

An attractive Valuation offers a margin of safety and reduces the risk of permanent losses.

-

Price Performance is important since the market anticipates the micro/macro condition changes.

-

Each factor:

- Carries a pre-defined weight, based on the objective we are trying to achieve.

- Is composed of several attributes, and each attribute also carries a pre-defined weight.

The final rank:

- Is allocated to each stock by weighting the ranks of each attribute and factor based on the corresponding exposure.

- Oscillates from 0.0 to 9.0, where 0.0 is the best and 9.0 is the worst. Because the model is sector-agnostic, it may well be that at times there are no high-ranked stocks within certain sectors.

The main purpose is to select profitable, cash-generating companies, reasonably priced.